How to create automatic expense reports?

3 methods are possible

- Strava

- Apple Health or Health Connect

- Motion detection and our AI.

You will also find ideas for possible combinations depending on the type of bike and application. For example, if you have a Bosch motor, you will be told how to synchronize this.

Is my phone compatible with automatic motion detection?

For Apple – iOS

All iPhones with iOS 17 or higher installed are compatible with motion detection.

For Google – Android

All PIXEL type Androids having installed Android 14 are compatible.

The Samsung S series were also tested (S22, S23, S24….)

The other phones are being tested for motion detection.

In the meantime, you can use Strava or Santé Connect synchronization.

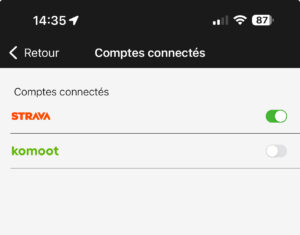

Can I sync my Strava data?

Yes. All you need to do is have a Strava account and connect it to Sweel. Then in the Sweel application, please configure your work schedule to only synchronize your work trips.

Do you have a Trek Electric bike?

If so, please follow these steps:

- Install the Trek app to manage your bike

- Connect your app to Strava in the user profile

- Install Sweel and choose Strava sync

- Configure your expense report in Sweel by choosing the days and working hours.

Do you have a bike with a Bosch engine?

If so, please follow these steps:

- Install the Bosch app to manage your bike

- Connect your app to Apple Health or Santé Connect or Strava

- Install Sweel and choose synchronization based on your previous choice.

- Configure your expense report in Sweel by choosing the days and working hours. Don’t forget to indicate the amount per KM.

Do you have a Mustache brand bike?

If so, please follow these steps:

- Install the Bosch app to manage your bike

- Connect your app to Apple Health or Santé Connect or Strava

- Install Sweel and choose synchronization based on your previous choice.

- Configure your expense report in Sweel by choosing the days and working hours.

How to connect Sweel to Winbooks Connect?

More info :

FR : https://help.winbooks.be/display/VIHelpFR/Email+To

NL : https://help.winbooks.be/display/VIHelpNL/Email+To

How to connect Sweel to Accountable?

It all starts from your inbox

You have receipts or purchase invoices you received on your email?

Simply add or forward us your invoice to expenses@accountable.eu and we will automatically import it.

You can import multiple PDFs at once: for each distinct file attached, we’ll create one invoice and do our best to pre-fill the necessary data for your taxes (see below).

You can also import plain HTML emails: we will automatically convert it into PDF and import it.

The only precaution? Make sure you send us the invoices from the email you are using in Accountable. That is how we know for sure it is yours.

Once in Accountable:

You should be notified once your expense has been processed (it typically takes 2-3 minutes). Once in the app, you should see it appear in the « Expenses » screen, at the top of the list, under the « Expenses to validate » tab.

Before this expense can count against your taxes, you need to validate the pre-booking that Accountable did: make sure the merchant is well identified and that the sub-totals and VAT totals are correct. Don’t forget to only tick the « invoice » tickbox if your VAT number figures on the document. Once done, validate the expense and, off you go, your VAT and expense totals have been updated.

How to connect Sweel to Odoo?

Instead of individually creating each expense in the Expenses app, expenses can be automatically created by sending an email to an email alias.

To do so, first, an email alias needs to be configured. Go to . Ensure Incoming Emails is enabled.

Note

If the domain alias needs to be set up, Setup your domain alias will appear beneath the incoming emails check box instead of the email address field. Refer to this documentation for setup instructions and more information: Domain names. Once the domain alias is configured, the email address field will be visible beneath the incoming emails section.

Next, enter the email address to be used in the email field, and then click Save. Now that the email address has been entered, emails can be sent to that alias to create new expenses without having to be in the Odoo database.

To submit an expense via email, create a new email and enter the product’s internal reference code (if available) and the amount of the expense in the email subject. Next, attach the receipt to the email. Odoo creates the expense by taking the information in the email subject and combining it with the receipt.

To check an expense categories internal reference, go to . If an internal reference is listed on the expense category, it is listed in the Internal Reference column.

What do we mean by bicycle?

By the term ‘bicycle’ we mean three types:

– The bicycle:

Any vehicle with 2 or more wheels:

that is driven by muscle power via pedals or handles

that is equipped with an electric auxiliary motor up to 250 W and no longer provides assistance from 25 km per hour (or earlier, if the driver stops pedaling)

The following types are included: classic bicycles, racing bicycles, mountain bikes, city bicycles, cargo bikes, adapted bicycles for the disabled (3 wheels, drive via handles, etc.), foldable bicycles, hybrid bicycles, with or without electric drive.

Not intended are: scooters, hoverboards, roller skates, skateboards, monowheels, (electric) segways. These are motorized or non-motorized locomotion devices.

– The motorized bicycle:

Any two-, three- or four-wheeled vehicle with pedals:

equipped with an electric auxiliary drive whose main purpose is pedal assistance, the driving force of which is interrupted at a maximum vehicle speed of 25 km per hour, excluding the bicycles mentioned above.

The rated continuous maximum power of the electric motor is a maximum of 1 kW.

– The speed pedelec:

Any two-wheeled vehicle with pedals (excluding motorized bicycles):

with an electric auxiliary drive whose main purpose is pedal assistance, the driving force of which is interrupted at a vehicle speed of maximum 45 km per hour.

The maximum rated continuous power of the electric motor shall not exceed 4 kW.

Comments

Motorized bicycles and speed pedelecs only qualify for favorable tax provisions if they are electrically powered.

The bicycles, motorized bicycles or speed pedelecs can be equipped with a garage button (also called Walk Assist, Park Assist, departure assistance, parking assistance, etc.), which allows them to move autonomously to a limited extent, for example to make it easier to walk up a slope with your bicycle. going on.

The so-called e-bike can only qualify because of its electric drive if it can be included in one of the 3 categories (bicycle, motorized bicycle or speed pedelec)*.

*There is no clear definition of an ‘e-bike’. These are bicycles where a throttle lever or button controls the electric motor and the driver no longer has to pedal. He can also cycle himself without switching on the motor.

What tax provisions exist with regard to a bicycle?

With an ecological aim, several measures have been taken to encourage the use of bicycles.

For example :

If you receive a bicycle allowance from your employer for your commuting, you can exempt this allowance from income tax up to a certain maximum amount:

For the 2024 tax year (2023 income), you can exempt the bicycle allowance up to a maximum of 0.27 euros per kilometer traveled.

For the 2025 tax year (2024 income), you can exempt the bicycle allowance up to a maximum of 0.35 euros per kilometer traveled and up to a maximum of 2,500 euros per year (3,500 euros subject to approval by the law).

Attention ! From the 2025 tax year (2024 income), the exemption from the bicycle allowance is only valid if your professional expenses are calculated as a flat rate. If you choose to deduct actual professional expenses in your tax return, you will no longer be entitled to this exemption from the 2025 tax year (2024 income).

If your employer provides you with a company bicycle, this is not considered a benefit in kind. You therefore do not pay tax on the benefit you receive. The condition, however, is that you regularly use the bicycle for your trips between your home and your place of work.

From the 2025 tax year (2024 income), the provision of a company bicycle is only exempt if your professional expenses are calculated on a flat-rate basis. If you choose to deduct actual professional expenses in your tax return, you will no longer be entitled to this exemption from the 2025 tax year (2024 income).

If you choose to justify your actual professional expenses, you can estimate the cost of your home-workplace travel by bike:

0.27 euros per kilometer traveled for the 2024 tax year (2023 income).

0.35 euros per kilometer traveled for the 2025 tax year (2024 income).

You can combine several of these benefits:

This allows you to combine the exemption from the benefit of a company bicycle with the exempt bicycle allowance.

Until the 2024 tax year (2023 income), you can also declare your actual professional expenses for an amount of 0.27 euros per kilometer traveled for your home-workplace travel in 2023. If you choose to declare your actual professional expenses, you must not deduct the exempt bicycle allowance from the total amount of the actual expenses calculated.

From tax year 2025 (income 2024), the combination with actual business expenses is no longer possible. From this financial year, the bicycle allowance and the provision of a company bicycle are only exempt if your professional expenses are calculated as a flat rate. If you choose to deduct actual professional expenses in your tax return, you will no longer be entitled to these exemptions from the 2025 tax year (2024 income).

What is a bicycle allowance?

A bicycle allowance is a mileage allowance that you receive from your employer for covering all or part of the journey between your home and your place of work by bicycle. For example, if you travel part of the journey by bicycle and part by public transport (train, bus or tram), you can receive a bicycle allowance for the part traveled by bicycle.

Examples:

You cycle to work every day for 220 working days. The distance between your home and your workplace is 5 km. The round trip is therefore 10 km. Your employer grants you a bicycle allowance of 0.24 euros per kilometer. You therefore receive each year 0.24 euros x 5 km x 2 (round trip) x 220 days of work = 528 euros.

You cycle to work every day for 220 working days. The distance between your home and your workplace is 20 km. The round trip is therefore 40 km. Your employer grants you a bicycle allowance of 0.22 euros per kilometer. You therefore receive each year 0.22 euros x 20 km x 2 (round trip) x 220 days of work = 1,936 euros.

The aim of the bicycle allowance is to encourage more workers to use their bicycles and to cover the costs of using the bicycle.